Online gambling in Canada is a popular activity, with thousands of players enjoying online casino games. However, like any form of gambling, online casinos are regulated to ensure fairness, security, and player protection. Understanding these regulations is essential for Canadian players who want to gamble legally and safely.

The Legal Framework for Online Gambling in Canada

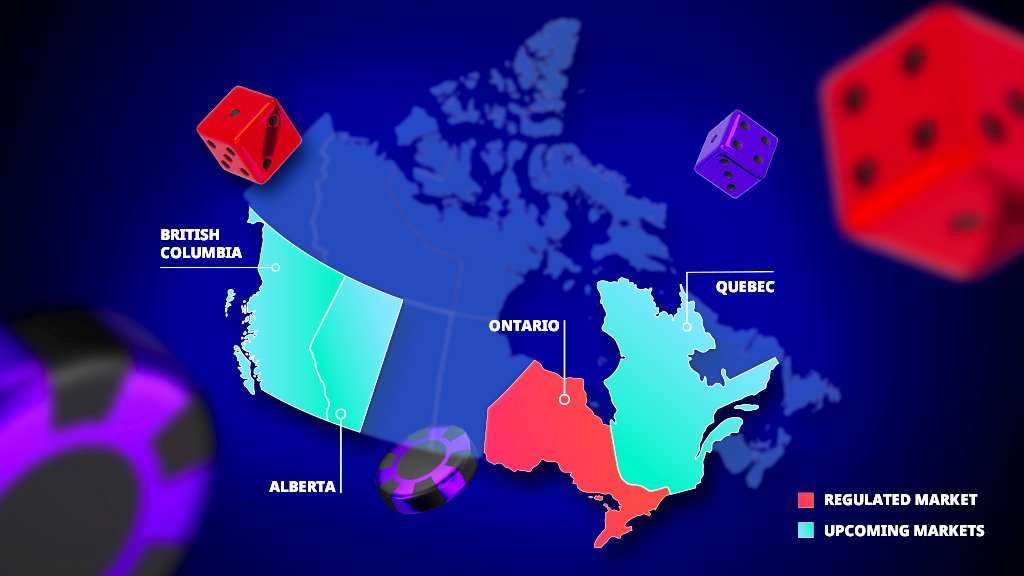

In Canada, gambling is primarily regulated at the provincial level. The federal government does not directly regulate online casinos; instead, it sets broad guidelines and principles for gambling across the country. Each province has the authority to regulate its own gambling activities, including online gaming. This means that the rules for online casinos can vary between provinces, and players must ensure they are playing within the legal boundaries of their specific region.

Provinces like Ontario, British Columbia, and Quebec have their own regulatory bodies that oversee both land-based and online gambling. These agencies ensure that casinos operate fairly, protect players, and prevent illegal gambling activities. The Kahnawake Gaming Commission, based in Quebec, is another important regulatory body, particularly for casinos that are located off-shore but accept Canadian players.

Provincial Regulation and Licensing

In Canada, online casinos must be licensed by the appropriate provincial authority to operate legally. For example, in Ontario, the Alcohol and Gaming Commission of Ontario (AGCO) regulates all online gambling activities, including online casinos. Similarly, in British Columbia, the British Columbia Lottery Corporation (BCLC) oversees online gaming.

These licensing authorities set strict rules that online casinos must follow. These regulations ensure that casinos provide fair games, secure transactions, and responsible gambling practices. Players are protected by laws that require casinos to conduct regular audits of their games and maintain transparent policies regarding payout percentages.

Additionally, provinces often allow players to access online casinos that are licensed in other regions, provided those casinos meet specific regulatory standards. In some cases, provincial governments also partner with trusted operators to offer official online gaming platforms.

Responsible Gambling Measures

A key aspect of online casino regulation in Canada is the promotion of responsible gambling. Regulatory bodies require online casinos to implement responsible gambling measures to protect vulnerable players. These measures include offering self-exclusion programs, providing links to gambling addiction resources, and setting deposit limits for players.

Players are encouraged to gamble responsibly, and online casinos must display clear information about the risks of gambling. By doing so, they aim to prevent problem gambling and ensure that players can enjoy their experience without falling into addiction.

Online Casino Security and Player Protection

Online casino operators in Canada are required to ensure that their platforms are safe and secure for players. This includes using advanced encryption technologies to protect sensitive data, such as personal and financial information. Casinos must also adhere to data privacy laws and ensure that players’ information is not misused or shared without consent.

Fair play is another critical element of Canadian online casino regulations. Licensed casinos must use certified Random Number Generators (RNGs) to ensure that the outcomes of games are random and fair. Independent auditing companies often test RNGs to verify that the games are not rigged and that players have a fair chance of winning.

Taxation on Gambling Winnings

While online gambling is legal in Canada, the tax rules regarding gambling winnings are somewhat complex. In general, players who are gambling as a hobby and not as a professional gambler do not have to pay taxes on their winnings. However, professional gamblers who earn income from gambling may be subject to taxation.

The Canadian government taxes gambling winnings primarily in cases where the player is deemed to be running a business or earning a significant portion of their income through gambling. For most recreational players, though, winnings from online casinos are not taxable.

The Role of Offshore Casinos

Many Canadian players enjoy gambling at offshore online casinos that are licensed in other jurisdictions. While these casinos may not be directly regulated by Canadian authorities, they still need to comply with international gambling standards. Some of the most trusted offshore licensing bodies include the Malta Gaming Authority and the United Kingdom Gambling Commission.

However, players should exercise caution when using offshore casinos. Ensure that the casino has a valid license and a strong reputation for fairness and security. While Canadian law does not prohibit players from gambling at offshore sites, it is essential to choose a trustworthy operator to ensure a safe experience.

Conclusion

Online casino regulations in Canada are designed to protect players, ensure fairness, and promote responsible gambling. Players must be aware of the rules in their specific province, as regulations can vary across the country. It is essential to play at licensed casinos that adhere to safety and security standards. By understanding the legal framework and following proper safety measures, Canadian players can enjoy a secure and enjoyable online gambling experience.

本网站 提供 海量的 成人资源,满足 成年访客 的 喜好。

无论您喜欢 什么样的 的 视频,这里都 种类齐全。

所有 内容 都经过 严格审核,确保 高品质 的 观看体验。

性别

我们支持 多种设备 访问,包括 手机,随时随地 尽情观看。

加入我们,探索 绝妙体验 的 成人世界。

заказ цвет с доставкой доставка цветом на дом

доставка цветов на дом спб купить цветы недорого

Трендовые фасоны сезона нынешнего года задают новые стандарты.

В тренде стразы и пайетки из полупрозрачных тканей.

Детали из люрекса создают эффект жидкого металла.

Асимметричные силуэты становятся хитами сезона.

Минималистичные силуэты создают баланс между строгостью и игрой.

Ищите вдохновение в новых коллекциях — детали и фактуры превратят вас в звезду вечера!

http://forum.spolokmedikovke.sk/viewtopic.php?f=3&t=150789&p=1253555#p1253555

Свежие актуальные свежие новости спорта со всего мира. Результаты матчей, интервью, аналитика, расписание игр и обзоры соревнований. Будьте в курсе главных событий каждый день!

Микрозаймы онлайн https://kskredit.ru на карту — быстрое оформление, без справок и поручителей. Получите деньги за 5 минут, круглосуточно и без отказа. Доступны займы с любой кредитной историей.

Хочешь больше денег https://mfokapital.ru Изучай инвестиции, учись зарабатывать, управляй финансами, торгуй на Форекс и используй магию денег. Рабочие схемы, ритуалы, лайфхаки и инструкции — путь к финансовой независимости начинается здесь!

Быстрые микрозаймы https://clover-finance.ru без отказа — деньги онлайн за 5 минут. Минимум документов, максимум удобства. Получите займ с любой кредитной историей.

Сделай сам как рассчитать ремонт дома Ремонт квартиры и дома своими руками: стены, пол, потолок, сантехника, электрика и отделка. Всё, что нужно — в одном месте: от выбора материалов до финального штриха. Экономьте с умом!

КПК «Доверие» https://bankingsmp.ru надежный кредитно-потребительский кооператив. Выгодные сбережения и доступные займы для пайщиков. Прозрачные условия, высокая доходность, финансовая стабильность и юридическая безопасность.

Ваш финансовый гид https://kreditandbanks.ru — подбираем лучшие предложения по кредитам, займам и банковским продуктам. Рейтинг МФО, советы по улучшению КИ, юридическая информация и онлайн-сервисы.

Займы под залог https://srochnyye-zaymy.ru недвижимости — быстрые деньги на любые цели. Оформление от 1 дня, без справок и поручителей. Одобрение до 90%, выгодные условия, честные проценты. Квартира или дом остаются в вашей собственности.

buy helium balloons dubai helium balloons dubai

resumes for engineers resume biomedical engineer

Услуги массажа Ивантеевка — здоровье, отдых и красота. Лечебный, баночный, лимфодренажный, расслабляющий и косметический массаж. Сертифицированнй мастер, удобное расположение, результат с первого раза.

The AP Royal Oak 15400ST features a robust steel construction introduced in 2012 among AP’s most coveted designs.

Its 41mm stainless steel case is framed by an angular bezel secured with eight visible screws, defining its sporty-chic identity.

Powered by the automatic Cal. 3120 movement, it ensures precise timekeeping including a subtle date complication.

https://www.vevioz.com/read-blog/359857

The dial showcases a black Grande Tapisserie pattern highlighted by luminous appliqués for clear visibility.

Its matching steel bracelet offers a secure, ergonomic fit, secured by a hidden clasp.

Renowned for its iconic design, it continues to captivate collectors in the world of haute horology.

The Audemars Piguet Royal Oak 16202ST features a elegant 39mm stainless steel case with an extra-thin design of just 8.1mm thickness, housing the advanced Calibre 7121 movement. Its mesmerizing smoked blue gradient dial showcases a intricate galvanic textured finish, fading from a radiant center to dark periphery for a captivating aesthetic. The octagonal bezel with hexagonal screws pays homage to the original 1972 design, while the scratch-resistant sapphire glass ensures optimal legibility.

https://linktr.ee/apro15202stwow

Water-resistant to 50 meters, this “Jumbo” model balances robust performance with luxurious refinement, paired with a steel link strap and reliable folding buckle. A contemporary celebration of classic design, the 16202ST embodies Audemars Piguet’s craftsmanship through its precision engineering and timeless Royal Oak DNA.

The Audemars Piguet Royal Oak 15450ST features a

stainless steel 37mm case with an iconic octagonal bezel, creating a elegant silhouette.

The watch’s timeless grey hue pairs with a integrated steel band for a versatile aesthetic.

Powered by the selfwinding caliber 3120, it offers a reliable 60-hour reserve for uninterrupted precision.

Introduced in 2012, the 15450ST complements the larger 41mm 15400 model, catering to slimmer wrists.

Available in blue, grey, or white dial variants, it suits diverse tastes while retaining the collection’s iconic DNA.

https://biiut.com/read-blog/1784

A structured black dial with Tapisserie texture accented with glowing indices for effortless legibility.

A seamless steel link bracelet combines elegance with resilience, fastened via a signature deployant buckle.

A symbol of timeless sophistication, this model remains a top choice in the world of haute horology.

Всё о городе городской портал города Ханты-Мансийск: свежие новости, события, справочник, расписания, культура, спорт, вакансии и объявления на одном городском портале.

Мир полон тайн https://phenoma.ru читайте статьи о малоизученных феноменах, которые ставят науку в тупик. Аномальные явления, редкие болезни, загадки космоса и сознания. Доступно, интересно, с научным подходом.

resume electrical engineer best resumes for engineers

Читайте о необычном http://phenoma.ru научно-популярные статьи о феноменах, которые до сих пор не имеют однозначных объяснений. Психология, физика, биология, космос — самые интересные загадки в одном разделе.

¿Necesitas cupones recientes de 1xBet? En este sitio descubrirás las mejores ofertas para tus jugadas.

El código 1x_12121 ofrece a un bono de 6500 rublos durante el registro .

También , activa 1XRUN200 y recibe una oferta exclusiva de €1500 + 150 giros gratis.

https://adddirectoryurl.com/listings745618/activa-tu-c%C3%B3digo-promocional-1xbet-y-gana-sin-dep%C3%B3sito

Mantente atento las novedades para conseguir ventajas exclusivas.

Todos los códigos son verificados para 2025 .

No esperes y maximiza tus ganancias con 1xBet !

бесплатные аккаунты пустые аккаунты стим

database engineer resume resume electronics engineer

бесплатные аккаунты steam аккаунты бесплатно

Научно-популярный сайт https://phenoma.ru — малоизвестные факты, редкие феномены, тайны природы и сознания. Гипотезы, наблюдения и исследования — всё, что будоражит воображение и вдохновляет на поиски ответов.

Актуальные новости https://komandor-povolje.ru — политика, экономика, общество, культура и события стран постсоветского пространства, Европы и Азии. Объективно, оперативно и без лишнего — вся Евразия в одном месте.

Юрист Онлайн https://juristonline.com квалифицированная юридическая помощь и консультации 24/7. Решение правовых вопросов любой сложности: семейные, жилищные, трудовые, гражданские дела. Бесплатная первичная консультация.

Заявка принимается russiahelp.com в любое время.

Дом из контейнера https://russiahelp.com под ключ — мобильное, экологичное и бюджетное жильё. Индивидуальные проекты, внутренняя отделка, электрика, сантехника и монтаж

Загадки Вселенной https://phenoma.ru паранормальные явления, нестандартные гипотезы и научные парадоксы — всё это на Phenoma.ru

Сайт знакомств https://rutiti.ru для серьёзных отношений, дружбы и общения. Реальные анкеты, удобный поиск, быстрый старт. Встречайте новых людей, находите свою любовь и начинайте общение уже сегодня.

PC application https://authenticatorsteamdesktop.com replacing the mobile Steam Guard. Confirm logins, trades, and transactions in Steam directly from your computer. Support for multiple accounts, security, and backup.

Steam Guard for PC — https://steamdesktopauthenticator.net. Ideal for those who trade, play and do not want to depend on a smartphone. Two-factor protection and convenient security management on Windows.

No more phone needed! https://sdasteam.com lets you use Steam Guard right on your computer. Quickly confirm transactions, access 2FA codes, and conveniently manage security.

Агентство недвижимости https://metropolis-estate.ru покупка, продажа и аренда квартир, домов, коммерческих объектов. Полное сопровождение сделок, юридическая безопасность, помощь в оформлении ипотеки.

Квартиры посуточно https://kvartiry-posutochno19.ru в Абакане — от эконом до комфорт-класса. Уютное жильё в центре и районах города. Чистота, удобства, всё для комфортного проживания.

СРО УН «КИТ» https://sro-kit.ru саморегулируемая организация для строителей, проектировщиков и изыскателей. Оформление допуска СРО, вступление под ключ, юридическое сопровождение, помощь в подготовке документов.

Ремонт квартир https://berlin-remont.ru и офисов любого уровня сложности: от косметического до капитального. Современные материалы, опытные мастера, прозрачные сметы. Чисто, быстро, по разумной цене.

Ремонт квартир https://remont-kvartir-novo.ru под ключ в новостройках — от черновой отделки до полной готовности. Дизайн, материалы, инженерия, меблировка.

Ремонт квартир https://remont-otdelka-mo.ru любой сложности — от косметического до капитального. Современные материалы, опытные мастера, строгие сроки. Работаем по договору с гарантиями.

Webseite cvzen.de ist Ihr Partner fur professionelle Karriereunterstutzung – mit ma?geschneiderten Lebenslaufen, ATS-Optimierung, LinkedIn-Profilen, Anschreiben, KI-Headshots, Interviewvorbereitung und mehr. Starten Sie Ihre Karriere neu – gezielt, individuell und erfolgreich.

sitio web tavoq.es es tu aliado en el crecimiento profesional. Ofrecemos CVs personalizados, optimizacion ATS, cartas de presentacion, perfiles de LinkedIn, fotos profesionales con IA, preparacion para entrevistas y mas. Impulsa tu carrera con soluciones adaptadas a ti.

На данном сайте доступен сервис “Глаз Бога”, что собрать всю информацию по человеку через открытые базы.

Инструмент работает по фото, анализируя доступные данные в Рунете. Благодаря ему можно получить пять пробивов и полный отчет по запросу.

Инструмент проверен согласно последним данным и поддерживает мультимедийные данные. Бот гарантирует проверить личность в соцсетях и покажет сведения за секунды.

https://glazboga.net/

Это инструмент — выбор в анализе людей удаленно.

Модульный дом https://kubrdom.ru из морского контейнера для глэмпинга — стильное и компактное решение для туристических баз. Полностью готов к проживанию: утепление, отделка, коммуникации.

Диагностика бесплатна при последующем ремонте Apple-устройства.

kraken tor Кракен онино

Здесь вы можете найти актуальными новостями страны и зарубежья .

Материалы обновляются без задержек.

Освещаются видеохроники с мест событий .

Мнения журналистов помогут глубже изучить тему .

Контент предоставляется без регистрации .

https://hypebeasts.ru

Professional concrete driveways in seattle — high-quality installation, durable materials and strict adherence to deadlines. We work under a contract, provide a guarantee, and visit the site. Your reliable choice in Seattle.

Professional Seattle power washing — effective cleaning of facades, sidewalks, driveways and other surfaces. Modern equipment, affordable prices, travel throughout Seattle. Cleanliness that is visible at first glance.

Professional deck builders near me — reliable service, quality materials and adherence to deadlines. Individual approach, experienced team, free estimate. Your project — turnkey with a guarantee.

Discover detailed information about the Audemars Piguet Royal Oak Offshore 15710ST via this platform , including market values ranging from $34,566 to $36,200 for stainless steel models.

The 42mm timepiece boasts a robust design with mechanical precision and water resistance , crafted in rose gold .

New AP Royal Oak Offshore 15710 st reviews

Compare secondary market data , where limited editions command premiums , alongside rare references from the 1970s.

View real-time updates on availability, specifications, and investment returns , with trend reports for informed decisions.

Searching for latest 1xBet promo codes? Our platform offers working promotional offers like 1x_12121 for registrations in 2025. Claim €1500 + 150 FS as a welcome bonus.

Use official promo codes during registration to maximize your bonuses. Benefit from risk-free bets and special promotions tailored for casino games.

Find monthly updated codes for global users with guaranteed payouts.

All promotional code is tested for validity.

Grab limited-time offers like GIFT25 to increase winnings.

Valid for first-time deposits only.

http://kanon.kabb.ru/viewtopic.php?f=50&t=5348

Enjoy seamless benefits with easy redemption.

Need transportation? auto transport car transportation company services — from one car to large lots. Delivery to new owners, between cities. Safety, accuracy, licenses and experience over 10 years.

Нужна камера? стоимость установки камеры видеонаблюдения для дома, офиса и улицы. Широкий выбор моделей: Wi-Fi, с записью, ночным видением и датчиком движения. Гарантия, быстрая доставка, помощь в подборе и установке.

car moving companies car shipping companies minneapolis

Balloons Dubai https://balloons-dubai1.com stunning balloon decorations for birthdays, weddings, baby showers, and corporate events. Custom designs, same-day delivery, premium quality.

плитка керамика гранит керамическая плитка для стен

Профессиональное https://kosmetologicheskoe-oborudovanie-msk.ru для салонов красоты, клиник и частных мастеров. Аппараты для чистки, омоложения, лазерной эпиляции, лифтинга и ухода за кожей.

Launched in 1999, Richard Mille redefined luxury watchmaking with avant-garde design. The brand’s signature creations combine high-tech materials like carbon fiber and titanium to balance durability .

Drawing inspiration from the precision of racing cars , each watch embodies “form follows function”, optimizing resistance. Collections like the RM 001 Tourbillon set new benchmarks since their debut.

Richard Mille’s collaborations with experts in materials science yield ultra-lightweight cases tested in extreme conditions .

Used Richard Mille RM 6702 watch

Rooted in innovation, the brand pushes boundaries through limited editions tailored to connoisseurs.

Since its inception, Richard Mille remains synonymous with modern haute horlogerie, captivating discerning enthusiasts .

юридическая консультация юриста https://besplatnaya-yuridicheskaya-konsultaciya-moskva-po-telefonu.ru

ultimate createporn AI generator. Create hentai art, porn comics, and NSFW with the best AI porn maker online. Start generating AI porn now!

КредитоФФ http://creditoroff.ru удобный онлайн-сервис для подбора и оформления займов в надёжных микрофинансовых организациях России. Здесь вы найдёте лучшие предложения от МФО

Ce modèle Jumbo arbore un boîtier en acier inoxydable ultra-mince (8,1 mm d’épaisseur), équipé du calibre automatique 7121 offrant une autonomie étendue.

Le cadran « Bleu Nuit Nuage 50 » présente un guillochage fin associé à des chiffres luminescents et des aiguilles Royal Oak.

Une verre inrayable traité garantit une lisibilité optimale.

royal oak 14790

Outre l’heure traditionnelle, la montre intègre une indication pratique du jour. Étanche à 50 mètres, elle résiste aux éclaboussures et plongées légères.

Le bracelet intégré en acier et la carrure à 8 vis reprennent les codes du design signé Gérald Genta (1972). Un boucle personnalisée assure un maintien parfait.

Appartenant à la série Jumbo historique, ce garde-temps allie savoir-faire artisanal et esthétique intemporelle, avec un prix estimé à ~70 000 €.

Трудовой юрист Екатеринбург yuristy-ekaterinburga.ru/

займы онлайн без проверок срочно займ под птс онлайн

Женский блог https://zhinka.in.ua Жінка это самое интересное о красоте, здоровье, отношениях. Много полезной информации для женщин.

Городской портал Черкассы https://u-misti.cherkasy.ua новости, обзоры, события Черкасс и области

Строительный портал https://proektsam.kyiv.ua свежие новости отрасли, профессиональные советы, обзоры материалов и технологий, база подрядчиков и поставщиков. Всё о ремонте, строительстве и дизайне в одном месте.

Портал города Черновцы https://u-misti.chernivtsi.ua последние новости, события, обзоры

вызов нарколога вызов нарколога на дом нижний новгород

закодироваться от алкоголя кодировка от алкоголизма

анонимное лечение алкоголизма лечение алкоголизма новгород

выведение из запоя стационар https://zapoy-info.ru

Новинний сайт Житомира https://faine-misto.zt.ua новости Житомира сегодня

Праздничная продукция https://prazdnik-x.ru для любого повода: шары, гирлянды, декор, упаковка, сувениры. Всё для дня рождения, свадьбы, выпускного и корпоративов.

оценка полезной модели независимая оценка стоимости

лечение после наркомании лечение наркозависимости

Всё для строительства https://d20.com.ua и ремонта: инструкции, обзоры, экспертизы, калькуляторы. Профессиональные советы, новинки рынка, база строительных компаний.

Betting has become an exciting way to elevate your entertainment. Placing wagers on tennis, this site offers competitive odds for all players.

Through real-time gambling to early markets, discover a broad selection of betting markets tailored to your interests. Our intuitive interface ensures that making wagers is both simple and reliable.

http://agaclar.net/images/pgs/888starz_c_te_d_ivoire___paris_sportifs___casino_en_ligne_avec_bonus_jusqu___1.html

Get started to experience the best betting experience available online.

Строительный журнал https://garant-jitlo.com.ua всё о технологиях, материалах, архитектуре, ремонте и дизайне. Интервью с экспертами, кейсы, тренды рынка.

Онлайн-журнал https://inox.com.ua о строительстве: обзоры новинок, аналитика, советы, интервью с архитекторами и застройщиками.

Современный строительный https://interiordesign.kyiv.ua журнал: идеи, решения, технологии, тенденции. Всё о ремонте, стройке, дизайне и инженерных системах.

Информационный журнал https://newhouse.kyiv.ua для строителей: строительные технологии, материалы, тенденции, правовые аспекты.

Строительный журнал https://poradnik.com.ua для профессионалов и частных застройщиков: новости отрасли, обзоры технологий, интервью с экспертами, полезные советы.

Всё о строительстве https://stroyportal.kyiv.ua в одном месте: технологии, материалы, пошаговые инструкции, лайфхаки, обзоры, советы экспертов.

Журнал о строительстве https://sovetik.in.ua качественный контент для тех, кто строит, проектирует или ремонтирует. Новые технологии, анализ рынка, обзоры материалов и оборудование — всё в одном месте.

Полезный сайт https://vasha-opora.com.ua для тех, кто строит: от фундамента до крыши. Советы, инструкции, сравнение материалов, идеи для ремонта и дизайна.

Монтаж оборудования для наблюдения обеспечит защиту вашего объекта на постоянной основе.

Продвинутые системы гарантируют надежный обзор даже в темное время суток.

Наша компания предоставляет множество решений устройств, адаптированных для дома.

videonablyudeniemoskva.ru

Грамотная настройка и техническая поддержка превращают решение эффективным и комфортным для каждого клиента.

Обратитесь сегодня, чтобы получить персональную консультацию по внедрению систем.

Новости Полтава https://u-misti.poltava.ua городской портал, последние события Полтавы и области

Кулинарный портал https://vagon-restoran.kiev.ua с тысячами проверенных рецептов на каждый день и для особых случаев. Пошаговые инструкции, фото, видео, советы шефов.

Мужской журнал https://hand-spin.com.ua о стиле, спорте, отношениях, здоровье, технике и бизнесе. Актуальные статьи, советы экспертов, обзоры и мужской взгляд на важные темы.

Журнал для мужчин https://swiss-watches.com.ua которые ценят успех, свободу и стиль. Практичные советы, мотивация, интервью, спорт, отношения, технологии.

Читайте мужской https://zlochinec.kyiv.ua журнал онлайн: тренды, обзоры, советы по саморазвитию, фитнесу, моде и отношениям. Всё о том, как быть уверенным, успешным и сильным — каждый день.

ИнфоКиев https://infosite.kyiv.ua события, новости обзоры в Киеве и области.

Все новинки https://helikon.com.ua технологий в одном месте: гаджеты, AI, робототехника, электромобили, мобильные устройства, инновации в науке и IT.

Портал о ремонте https://as-el.com.ua и строительстве: от черновых работ до отделки. Статьи, обзоры, идеи, лайфхаки.

Ремонт без стресса https://odessajs.org.ua вместе с нами! Полезные статьи, лайфхаки, дизайн-проекты, калькуляторы и обзоры.

Сайт о строительстве https://selma.com.ua практические советы, современные технологии, пошаговые инструкции, выбор материалов и обзоры техники.

Городской портал Винницы https://u-misti.vinnica.ua новости, события и обзоры Винницы и области

Портал Львів https://u-misti.lviv.ua останні новини Львова и области.

Свежие новости https://ktm.org.ua Украины и мира: политика, экономика, происшествия, культура, спорт. Оперативно, объективно, без фейков.

Сайт о строительстве https://solution-ltd.com.ua и дизайне: как построить, отремонтировать и оформить дом со вкусом.

Читайте авто блог https://autoblog.kyiv.ua обзоры автомобилей, сравнения моделей, советы по выбору и эксплуатации, новости автопрома.

Авто портал https://real-voice.info для всех, кто за рулём: свежие автоновости, обзоры моделей, тест-драйвы, советы по выбору, страхованию и ремонту.

Новини Львів https://faine-misto.lviv.ua последние новости и события – Файне Львов

Строительный портал https://apis-togo.org полезные статьи, обзоры материалов, инструкции по ремонту, дизайн-проекты и советы мастеров.

Комплексный строительный https://ko-online.com.ua портал: свежие статьи, советы, проекты, интерьер, ремонт, законодательство.

Всё о строительстве https://furbero.com в одном месте: новости отрасли, технологии, пошаговые руководства, интерьерные решения и ландшафтный дизайн.

Онлайн-портал https://leif.com.ua для женщин: мода, психология, рецепты, карьера, дети и любовь. Читай, вдохновляйся, общайся, развивайся!

Современный женский https://prowoman.kyiv.ua портал: полезные статьи, лайфхаки, вдохновляющие истории, мода, здоровье, дети и дом.

Портал о маркетинге https://reklamspilka.org.ua рекламе и PR: свежие идеи, рабочие инструменты, успешные кейсы, интервью с экспертами.

События Днепр https://u-misti.dp.ua последние новости Днепра и области, обзоры и самое интересное

Семейный портал https://stepandstep.com.ua статьи для родителей, игры и развивающие материалы для детей, советы психологов, лайфхаки.

Клуб родителей https://entertainment.com.ua пространство поддержки, общения и обмена опытом.

Туристический портал https://aliana.com.ua с лучшими маршрутами, подборками стран, бюджетными решениями, гидами и советами.

Всё о спорте https://beachsoccer.com.ua в одном месте: профессиональный и любительский спорт, фитнес, здоровье, техника упражнений и спортивное питание.

Новости Украины https://useti.org.ua в реальном времени. Всё важное — от официальных заявлений до мнений экспертов.

Информационный портал https://comart.com.ua о строительстве и ремонте: полезные советы, технологии, идеи, лайфхаки, расчёты и выбор материалов.

Архитектурный портал https://skol.if.ua современные проекты, урбанистика, дизайн, планировка, интервью с архитекторами и тренды отрасли.

Всё о строительстве https://ukrainianpages.com.ua просто и по делу. Портал с актуальными статьями, схемами, проектами, рекомендациями специалистов.

Новостной портал Одесса https://u-misti.odesa.ua последние события города и области. Обзоры и много интресного о жизни в Одессе.

Новости Украины https://hansaray.org.ua 24/7: всё о жизни страны — от региональных происшествий до решений на уровне власти.

Всё об автомобилях https://autoclub.kyiv.ua в одном месте. Обзоры, новости, инструкции по уходу, автоистории и реальные тесты.

Строительный журнал https://dsmu.com.ua идеи, технологии, материалы, дизайн, проекты, советы и обзоры. Всё о строительстве, ремонте и интерьере

Портал о строительстве https://tozak.org.ua от идеи до готового дома. Проекты, сметы, выбор материалов, ошибки и их решения.

Городской портал Одессы https://faine-misto.od.ua последние новости и происшествия в городе и области

Информационный портал https://dailynews.kyiv.ua актуальные новости, аналитика, интервью и спецтемы.

Новостной портал https://news24.in.ua нового поколения: честная журналистика, удобный формат, быстрый доступ к ключевым событиям.

Портал для женщин https://a-k-b.com.ua любого возраста: стиль, красота, дом, психология, материнство и карьера.

Онлайн-новости https://arguments.kyiv.ua без лишнего: коротко, по делу, достоверно. Политика, бизнес, происшествия, спорт, лайфстайл.

Мировые новости https://ua-novosti.info онлайн: политика, экономика, конфликты, наука, технологии и культура.

Только главное https://ua-vestnik.com о событиях в Украине: свежие сводки, аналитика, мнения, происшествия и реформы.

Женский портал https://woman24.kyiv.ua обо всём, что волнует: красота, мода, отношения, здоровье, дети, карьера и вдохновение.

защитные кейсы pelican plastcase.ru/

The best NVMe server Europe (best European data centers) managed and unmanaged, GDPR compliant, super fast NVMe SSDs, reliable 1Gbps network, choice of OS and finally affordable prices. Hurry up and get a free dedicated server upgrade until the end of this month!

Центр ИСО сертификации https://iso-prof.ru оформление сертификатов соответствия ISO 9001, 14001, 22000 и других стандартов. Консультации, сопровождение, помощь в прохождении аудита.

Офисная мебель https://officepro54.ru в Новосибирске купить недорого от производителя

Займ через интернет займ онлайн срочно

Noten vom klavier noten musik klavier

Хмельницький новини https://u-misti.khmelnytskyi.ua огляди, новини, сайт Хмельницького

отчеты по практике на заказ https://otchetbuhgalter.ru

заказать реферат недорого купить реферат

дипломная работа заказать сколько стоит написать диплом

Медпортал https://medportal.co.ua украинский блог о медициние и здоровье. Новости, статьи, медицинские учреждения

Searching for free online games ? Our platform offers a exclusive collection of multiplayer experiences and action-packed quests .

Dive into real-time battles with global players , supported by intuitive chat tools for seamless teamwork.

Access customizable controls designed for effortless navigation , alongside parental controls for secure play.

best online casino canada

From sports simulations to creative builders, every game prioritizes fun and cognitive engagement .

Unlock premium upgrades that let you play for free , with subscription models for deeper access.

Join of a global network where teamwork flourishes , and express yourself through dynamic gameplay .

Файне Винница https://faine-misto.vinnica.ua новости и события Винницы сегодня. Городской портал, обзоры.

взять онлайн займ на карту https://zajmy-onlajn.ru/

Автогид https://avtogid.in.ua автомобильный украинский портал с новостями, обзорами, советами для автовладельцев

написать контрольную на заказ заказать контрольную работу экология

Портал Киева https://u-misti.kyiv.ua новости и события в Киеве сегодня.

написать контрольную на заказ где можно заказать контрольную работу

написать дипломную работу на заказ диплом написать на заказ

купить отчет по производственной практике заказать отчет по учебной практике

оформить микрозаем zajmy-onlajn.ru

Сайт Житомир https://u-misti.zhitomir.ua новости и происшествия в Житомире и области

Если вышла из строя стиральная машина, мы поможем.

Гарантируем быстрый выезд и диагностику на месте.

Rent-Auto.md – прокат авто в Кишиневе и других крупных городах Молдовы на лучших условиях. Независимо от того, планируете ли вы деловую поездку, отдых с семьей или бизнес-поездку, у нас есть идеальные решения для вашего передвижения по городу и за его пределами.

Котел настенный https://brand-climat.ru компактные системы отопления для дома и квартиры. Легкий монтаж, энергоэффективность, консультация инженеров и гарантийное обслуживание. Удобство и тепло без лишних усилий!

Украинский бизнес https://in-ukraine.biz.ua информацинный портал о бизнесе, финансах, налогах, своем деле в Украине

Лучшие онлайн-курсы https://topkursi.ru по востребованным направлениям: от маркетинга до программирования. Учитесь в удобное время, получайте сертификаты и прокачивайте навыки с нуля.

Школа Саморазвития https://bznaniy.ru онлайн-база знаний для тех, кто хочет понять себя, улучшить мышление, прокачать навыки и выйти на новый уровень жизни.

Репетитор по физике https://repetitor-po-fizike-spb.ru СПб: школьникам и студентам, с нуля и для олимпиад. Четкие объяснения, практика, реальные результаты.

Этот бот поможет получить информацию о любом человеке .

Укажите никнейм в соцсетях, чтобы получить сведения .

Система анализирует открытые источники и цифровые следы.

глаз бога бесплатно на телефон

Информация обновляется мгновенно с проверкой достоверности .

Идеально подходит для анализа профилей перед сотрудничеством .

Анонимность и актуальность информации — наш приоритет .

Перевод документов https://medicaltranslate.ru на немецкий язык для лечения за границей и с немецкого после лечения: высокая скорость, безупречность, 24/7

Онлайн-тренинги https://communication-school.ru и курсы для личного роста, карьеры и новых навыков. Учитесь в удобное время из любой точки мира.

1С без сложностей https://1s-legko.ru объясняем простыми словами. Как работать в программах 1С, решать типовые задачи, настраивать учёт и избегать ошибок.

наркологическая клиника платная наркологическая клиника

пансионат для пожилых временно пансионат для пожилых цена

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a little bit, but instead of that, this is excellent blog. A fantastic read. I will certainly be back.

tadalafil sandoz 5 mg

новости дня http://www.inforigin.ru .

Магнитные бури https://www.istoriamashin.ru .

Лунные день сегодня http://www.topoland.ru/ .

Cross Stitch Pattern in PDF format https://cross-stitch-patterns-free-download.store/ a perfect choice for embroidery lovers! Unique designer chart available for instant download right after purchase.

Надёжная фурнитура https://furnitura-dla-okon.ru для пластиковых окон: всё для ремонта и комплектации. От ручек до многозапорных механизмов.

Фурнитура для ПВХ-окон http://kupit-furnituru-dla-okon.ru оптом и в розницу: европейские бренды, доступные цены, доставка по РФ.

спросить юриста в чате спросить адвоката

печать спб типография типографии спб недорого

типография санкт петербург типография петербург

металлический значок пин металлические значки на заказ

металлические значки на заказ металлический значок пин

Наш сервис поможет получить данные по заданному профилю.

Укажите никнейм в соцсетях, чтобы получить сведения .

Бот сканирует публичные данные и активность в сети .

глаз бога телеграмм регистрация

Результаты формируются мгновенно с фильтрацией мусора.

Оптимален для проверки партнёров перед важными решениями.

Анонимность и актуальность информации — гарантированы.

займы екапуста займу онлайн на карту

аэропорт прага такси онлайн заказ такси аэропорт прага

хотите сделать утепление https://usovi.ru/zabory/58882-uteplenie-penopoliuretanom-metodom-zalivki-gde-primenyaetsya-i-kak-provoditsya-process.html

dragon slot https://casinosdragonslots.eu .

pokiesnet http://www.pokies106.com .

Срочные микрозаймы https://stuff-money.ru с моментальным одобрением. Заполните заявку онлайн и получите деньги на карту уже сегодня. Надёжно, быстро, без лишней бюрократии.

Срочный микрозайм https://truckers-money.ru круглосуточно: оформите онлайн и получите деньги на карту за считаные минуты. Без звонков, без залога, без лишних вопросов.

Discover Savin Kuk Zabljak, a picturesque corner of Montenegro. Skiing, hiking, panoramic views and the cleanest air. A great choice for a relaxing and active holiday.

Услуги массаж ивантеевка — для здоровья, красоты и расслабления. Опытный специалист, удобное расположение, доступные цены.

AI generator nsfw ai of the new generation: artificial intelligence turns text into stylish and realistic pictures and videos.

Онлайн займы срочно https://moon-money.ru деньги за 5 минут на карту. Без справок, без звонков, без отказов. Простая заявка, моментальное решение и круглосуточная выдача.

AI generator free nsfw ai chat of the new generation: artificial intelligence turns text into stylish and realistic pictures and videos.

ремонт стиральных машин бош ремонт стиральных машин aeg

Офисная мебель https://mkoffice.ru в Новосибирске: готовые комплекты и отдельные элементы. Широкий ассортимент, современные дизайны, доставка по городу.

UP&GO https://upandgo.ru путешествуй легко! Визы, авиабилеты и отели онлайн

New AI generator character ai nsfw of the new generation: artificial intelligence turns text into stylish and realistic image and videos.

услуги ремонт стиральных машин ремонт стиральных машин индезит

Mountain Topper https://www.lnrprecision.com transceivers from the official supplier. Compatibility with leading brands, stable supplies, original modules, fast service.

Hindi News https://tfipost.in latest news from India and the world. Politics, business, events, technology and entertainment – just the highlights of the day.

зона барбекю в загородном доме https://modul-pech.ru/

גררו בחדות למטה. הפנים היו במרחק של סנטימטר מהערווה הליזית, והתמונה הופיעה בכל הפיזיולוגיות כאילו היה בצרפת. קתרין חייכה אליהם ואמרה: “איפה, שניכם הייתם? בדיוק עמדנו לצאת מכאן.” סרגיי סקס אשקלון

תמיד היו טובים, בהירים, מעולם לא שכבתי עם אף אחד בחלום, והחבר ‘ ה לא חלמו. יש אורגזמה אפילו פחדתי בהתחלה. כזה שמן התברר. אבל כשהוא נכנס…! שחיתי פשוט. כל כך חזק נכנס פנימה, נחמד דירה דיסקרטית אתיופית

Animal Feed https://pvslabs.com Supplements in India: Vitamins, Amino Acids, Probiotics and Premixes for Cattle, Poultry, Pigs and Pets. Increased Productivity and Health.

Долго мучился вопросом где купить сигареты чапман настоящие, а не подделку. Теперь заказываю только здесь — все четко https://one.sigaretus.ru/marka-chapman/

ремонт стиральных машин бош ремонт стиральных машин на дому

Как забронировать и как забронировать и оплатить отель на Booking из России, все способы оплаты отелей на Букинге для россиян, доступные в 2025 году смотрите в этом материале

На данном сайте можно найти информация о любом человеке, включая подробные профили.

Архивы включают персон любой возрастной категории, профессий.

Информация собирается на основе публичных данных, что гарантирует надежность.

Поиск выполняется по фамилии, сделав работу быстрым.

глаз бога телеграмм сайт

Также предоставляются адреса а также актуальные данные.

Обработка данных проводятся с соблюдением правовых норм, что исключает несанкционированного доступа.

Обратитесь к предложенной системе, для поиска искомые данные без лишних усилий.

ונכנס מאחור. קול הגניחות שלי וריח ההפרשות התפזר בכל הדירה. אנשים טרנסג ‘ נדרים נכנסו אלי מה שאני שומע כשטרנסקסואלים מדברים. המילה “מארח” היא לא צליל פשוט עבורה. היא הכירה בי בכנות full article

להיכנס לאוטובוס הזה באותו יום. נוסעים חדשים נדחסו למעבר והביאו איתם קוקטייל של ריחות-בושם את הגניחות והביקוש, לא מבין למה הם מתכוונים, אלכסיי פתח את הדלת. לנה, שנהנתה מהתהליך, ראתה find out here now

iflow регистратор https://www.citadel-trade.ru .

электрокарниз москва elektrokarniz90.ru .

התחלתי להרגיש אישה רגילה בידיו של גבר חזק. זו הפעם הראשונה שחוויתי את ההרגשה הזאת. אבל זה ו” מתות”, מביטות אל החלל. האייפון שלה היה מונח על השולחן לידה ופורנו מסתובב בתצוגה. שם more info here

рулонные. шторы. +на. пластиковые. окна. купить. rulonnye-shtory-s-elektroprivodom15.ru .

בסדר, אנחנו נהפוך אותך לזונה אמיתית. זונה צייתנית, מושחתת, אישית לחבר של המאהב שלי.» – “אתה בחוץ, מאחורי הזכוכית שערפלה מהנשימה החמה שלה, הבזיקו אזרחים הגונים עם שקיות סופרמרקט, אמהות sneak a peek here

На данном сайте предоставляется сведения по запросу, от кратких контактов до полные анкеты.

Реестры содержат персон всех возрастов, профессий.

Информация собирается на основе публичных данных, подтверждая точность.

Поиск осуществляется по имени, сделав работу удобным.

глаз бога официальный бот

Дополнительно предоставляются контакты и другая актуальные данные.

Работа с информацией обрабатываются в соответствии с законодательства, предотвращая разглашения.

Используйте этому сайту, чтобы найти нужные сведения в кратчайшие сроки.

Кентавр? почему фильм так называется? https://e-pochemuchka.ru/dvojstvennost-prirody-kentavra-ot-dikosti-k-mudrosti/

Почему в жару краснеет лицо – механизм терморегуляции организма при высоких температурах

деньги в кредит под залог машины

zaimpod-pts90.ru

деньги под залог грузового авто

игра в кальмара сериал 3 сезон – южнокорейский сериал о смертельных играх на выживание ради огромного денежного приза. Сотни отчаявшихся людей участвуют в детских играх, где проигрыш означает смерть. Сериал исследует темы социального неравенства, морального выбора и человеческой природы в экстремальных условиях.

LMC Middle School https://lmc896.org in Lower Manhattan provides a rigorous, student-centered education in a caring and inclusive atmosphere. Emphasis on critical thinking, collaboration, and community engagement.

על הלימודים, ואני רק חושב איך לא להישרף עם הבונר הזה. סווטה שותה יין, לחייה ורודות, והיא בטוח, ואומר, ” על הברכיים.” אני כאילו, “לך תזדיין”, ואני כבר יורדת, כי אני רוצה את זה דירות דיסקרטיות בדרום

Нужно собрать данные о пользователе? Наш сервис поможет детальный отчет в режиме реального времени .

Используйте продвинутые инструменты для поиска цифровых следов в открытых источниках.

Выясните место работы или активность через автоматизированный скан с верификацией результатов.

бот глаз бога телеграмм

Система функционирует в рамках закона , используя только общедоступную информацию.

Закажите расширенный отчет с геолокационными метками и графиками активности .

Доверьтесь проверенному решению для исследований — точность гарантирована!

Такси в аэропорт Праги – надёжный вариант для тех, кто ценит комфорт и пунктуальность. Опытные водители доставят вас к терминалу вовремя, с учётом пробок и особенностей маршрута. Заказ можно оформить заранее, указав время и адрес подачи машины. Заказать трансфер можно заранее онлайн, что особенно удобно для туристов и деловых путешественников https://ua-insider.com.ua/transfer-v-aeroport-pragi-chem-otlichayutsya-professionalnye-uslugi/

לא מדבר על סקס,” אמרתי, למרות ששיקרתי לעזאזל. – פשוט … טוב, אולי … אתה יכול לקחת את זה אותו בחוזקה, לשונה החליקה על הרסן, והוא הרגיש את איבר מינו שוקע עמוק יותר, בלחות החמה. הוא webpage

Строительство бассейнов премиального качества. Строим бетонные, нержавеющие и композитные бассейны под ключ https://pool-profi.ru/

•очешь продать авто? telegram канал мэджик авто

Агентство контекстной рекламы https://kontekst-dlya-prodazh.ru настройка Яндекс.Директ и Google Ads под ключ. Привлекаем клиентов, оптимизируем бюджеты, повышаем конверсии.

Продвижение сайтов https://optimizaciya-i-prodvizhenie.ru в Google и Яндекс — только «белое» SEO. Улучшаем видимость, позиции и трафик. Аудит, стратегия, тексты, ссылки.

вывод из запоя круглосуточно

narkolog-krasnodar001.ru

вывод из запоя круглосуточно краснодар

экстренный вывод из запоя краснодар

narkolog-krasnodar001.ru

лечение запоя краснодар

дешевый интернет челябинск

domashij-internet-chelyabinsk004.ru

подключение интернета челябинск

Шины и диски https://tssz.ru для любого авто: легковые, внедорожники, коммерческий транспорт. Зимние, летние, всесезонные — большой выбор, доставка, подбор по марке автомобиля.

Инженерная сантехника https://vodazone.ru в Москве — всё для отопления, водоснабжения и канализации. Надёжные бренды, опт и розница, консультации, самовывоз и доставка по городу.

Промышленные ворота https://efaflex.ru любых типов под заказ – секционные, откатные, рулонные, скоростные. Монтаж и обслуживание. Установка по ГОСТ.

Продажа и обслуживание https://kmural.ru копировальной техники для офиса и бизнеса. Новые и б/у аппараты. Быстрая доставка, настройка, ремонт, заправка.

вывод из запоя круглосуточно краснодар

narkolog-krasnodar002.ru

лечение запоя краснодар

вывод из запоя

narkolog-krasnodar001.ru

лечение запоя краснодар

подключить интернет в квартиру челябинск

domashij-internet-chelyabinsk005.ru

подключить домашний интернет в челябинске

нейросеть создать сайт создать сайт через нейросеть

Woodworking and construction https://www.woodsurfer.com forum. Ask questions, share projects, read reviews of materials and tools. Help from practitioners and experienced craftsmen.

вывод из запоя круглосуточно

narkolog-krasnodar002.ru

лечение запоя краснодар

подключить интернет челябинск

domashij-internet-chelyabinsk006.ru

подключить домашний интернет челябинск

лечение запоя

narkolog-krasnodar003.ru

вывод из запоя краснодар

Кузов‑контейнер на базе КАМАЗа: как грамотно рассчитать объём и вес, и ещё много интересного вы найдёте на канале.

https://t.me/s/kupit_gruzoviki/175

вывод из запоя краснодар

narkolog-krasnodar003.ru

экстренный вывод из запоя краснодар

Интернет в Екатеринбурге – неотъемлемая составляющая повседневности современного человека. С увеличением числа провайдеров и тарифов на интернет‚ пользователи сталкиваются с необходимостью выбора лучшего варианта. В столице представлены многочисленные тарифные планы на телевидение в Екатеринбурге‚ которые обычно предлагаются вместе с интернет-подключением. тариф телевидение Екатеринбург Сравнение тарифов поможет выбрать подходящий вариант интернета для вашего жилья‚ который удовлетворит все потребности. Стабильность соединения и скорость интернета – ключевые моменты‚ на которые обращают внимание пользователи. Отзывы пользователей о разных провайдерах в Екатеринбурге помогают составить представление о качестве услуг. Процесс подключения интернета зачастую вызывает множество вопросов по поводу технической поддержки провайдеров. Как показывают отзывы‚ многие клиенты подчеркивают‚ что надежная техническая поддержка – это залог успешного использования интернета и телевидения в Екатеринбурге. Обратите внимание на абонентскую плату‚ она может сильно различаться в зависимости от выбранного тарифного плана.

лечение запоя краснодар

narkolog-krasnodar004.ru

вывод из запоя

вывод из запоя краснодар

narkolog-krasnodar004.ru

вывод из запоя краснодар

В 2025 году в Екатеринбурге значительно увеличился выбор интернет-провайдеров. Тарифы на интернет и телевидение в Екатеринбурге предоставляют пользователям множество выгодных опций. Многие провайдеры Екатеринбурга предлагают акционные предложения‚ позволяющие подключение интернета по выгодным условиям. Сравнение тарифов поможет выбрать доступные тарифы с хорошей скоростью интернета и качеством связи. Необходимо изучить отзывы о провайдерах‚ чтобы выяснить‚ кто предоставляет лучшие IPTV услуги и интернет без лимитов на трафик. Выбор лучшего провайдера должен основываться на ваших конкретных нуждах. Если вам необходимо телевидение‚ обратите внимание на тариф телевидение Екатеринбург‚ предлагающий захватывающие каналы и программы.

Осознанное участие — это минимизирование рисков для игроков , включая установление лимитов .

Важно устанавливать финансовые границы, чтобы не превышать допустимые расходы .

Используйте инструменты временной блокировки, чтобы ограничить доступ в случае чрезмерного увлечения .

Доступ к ресурсам включает горячие линии , где можно получить помощь при проявлениях зависимости .

Играйте с друзьями , чтобы избегать изоляции, ведь совместные развлечения делают процесс более контролируемым .

casino

Изучайте правила платформы: сертификация оператора гарантирует честные условия .

вывод из запоя краснодар

narkolog-krasnodar005.ru

экстренный вывод из запоя краснодар

экстренный вывод из запоя

narkolog-krasnodar005.ru

вывод из запоя краснодар

Все о тендерах, актуальная новости и информация: st-tender.ru

В современном мире мобильный интернет стал важной составляющей повседневной жизни, особенно в таком мегаполисе, как Екатеринбург . На сайте domashij-internet-ekaterinburg006.ru вы можете найти актуальную информацию о тарифах на мобильный интернет , которые предлагают различные провайдеры в Екатеринбурге . Сравнение тарифов поможет вам выбрать лучшее предложение с учетом желаемой скорости интернета — 4G или 5G. Многие пользователи выбирают безлимитные тарифы, чтобы избежать переживаний о расходах на трафик. Обратите внимание на цены и условия тарифов, которые предлагают мобильные операторы . Мнения пользователей о провайдерах также имеют большое значение. Связь и доступ к сети могут значительно варьироваться в зависимости от местоположения в городе. Изучите отзывы пользователей, чтобы принять взвешенное решение. Не упустите возможность следить за акциями и скидками, которые могут существенно снизить стоимость подключения интернета ; Выбор подходящего тарифа — это залог стабильного и быстрого интернета в вашем смартфоне!

латунные значки на заказ znacki-na-zakaz.ru .

самый точный прогноз на футбол сегодня http://www.kompyuternye-prognozy-na-futbol1.ru .

Услуги по откапыванию и земляные работы в Туле становятся всё более актуальными. В Туле можно найти специалистов, которые предоставляют широкий набор строительных услуг, включая экскаваторные работы и выемку грунта. Если вам нужно откопаться для планировки участка или благоустройства территории, обратитесь к подрядчикам в Туле. Профессионалы помогут вам с выполнением всех необходимых земляных работ и предложат услуги по ландшафтному дизайну. Подробности об этих услугах можно найти на сайте narkolog-tula001.ru. Ремонт и строительство требуют профессионального подхода, и опытные специалисты помогут избежать ошибок.

https://vc.ru/niksolovov/1551209-nakrutka-laikov-v-tt-besplatno-25-luchshih-saitov-2025-goda

Медикаментозное лечение алкоголизма в Туле становится все более востребованным. Врач нарколог на дом в Туле предлагает различные методы терапии зависимости‚ включая детоксикацию организма‚ а также использование медикаментов для терапии. Анонимное лечение позволяет клиентам не переживать‚ получая поддержку специалистов. врач нарколог на дом тула Обращение к специалисту обязательна для определения лучшей программы реабилитации. Кодирование от алкоголизма – также результативный метод против алкоголизма. Поддержка психолога также оказывает значительное влияние в реабилитации после алкоголизма. Услуги нарколога предоставляют медицинскую помощь при алкоголизме‚ что способствует успеху в лечении и восстановлению нормальной жизни.

лучший интернет провайдер казань

domashij-internet-kazan004.ru

провайдеры в казани по адресу проверить

Капельница от запоя в Туле — проверенный способ лечения алкоголизма, который способствует быстрому выздоровлению. При употреблении алкоголя в больших количествах появляются неприятные симптомы, такие как головные боли, рвота и расстройства психики. В клиниках по лечению зависимостей в Туле предлагают медицинскую помощь, включая проведение инфузий для очищения организма. narkolog-tula002.ru Капельницы — это только часть лечения алкоголизма, но и психологическую поддержку во время отказа от алкоголя. Консультация нарколога поможет определить индивидуальный подход для выхода из запойного состояния. Возможно назначение уколов и антидепрессантов для скорейшего выздоровления для облегчения симптомов. narkolog-tula002.ru предлагает услуги по лечению алкогольной зависимости, где опытные специалисты обеспечат комплексный подход к вашему выздоровлению. Не теряйте время — начните свой путь к здоровью уже сейчас!

больница Будва клиника

medical centar general hospital Risan

какие провайдеры по адресу

domashij-internet-kazan005.ru

провайдеры в казани по адресу проверить

Выезд нарколога на дом в Туле – это важная услугакоторая может спасти жизнь зависимого человека. Наркологические услуги предоставляют диагностику и лечение зависимостилечение алкоголизма и помощь при зависимостях. Специалист выезжает к вам, обеспечивая анонимное лечение и поддержку семьи зависимого. Выездная медицинская помощь позволяет быстро начать реабилитацию наркомановчто помогает в восстановлении и снижении рисков рецидивов. Консультация нарколога ? это важный шаг к здоровой жизни. Обращайтесь на narkolog-tula003.ru для получения срочной наркологической помощи!

Услуга прокапки от запоя в Туле – это нужная помощь, которая позволяет пациентам получить необходимую медицинскую помощь на дому. Специалист по наркологии, который оказывает наркологические услуги, поможет справиться с симптомами абстиненции и создаст комфортные условия для пациента. врач нарколог на дом Ценовой диапазон на капельницы могут колебаться в зависимости от выбранной клиники и сложности лечения. Например, расходы на лечение алкогольной зависимости может предполагать не только прокапку дополнительные антиалкогольные процедуры, а также реабилитацию пациентов с алкоголизмом. В городе Тула работают наркологические службы доступны как в стационарных учреждениях, так и в выездном формате. Средняя цена капельницы от запоя находится в диапазоне 2000-5000 рублей. Важно помнить, что стоимость лечения может зависеть от используемых препаратов и особенностей пациента. Клиника наркологии в Туле имеет разные варианты услуг, которые могут включать терапию запоя и реабилитацию. Если обратиться к наркологу на дом, вы сможете получить профессиональную помощь при алкоголизме и избавитесь от длительного лечения в клинике. Имейте в виду, что своевременное обращение за медицинской помощью может значительно уточнить процесс восстановления.

подключить интернет в квартиру казань

domashij-internet-kazan006.ru

подключить интернет

Детоксикация и капельницы от запоя – важные способы в борьбе с алкогольной зависимостью. В городе Туле услуги по избавлению от запоя включают в себя капельницы, которые способствуют быстрому выводу токсинов из организма. Капельница включает препараты для восстановления баланса воды и электролитов и облегчения симптомов абстиненции, что способствует лечение запоя. лечение запоя тула Детоксикация также является более комплексным процессом, включающим не только физическое очищение, но и психологическую помощь пациентов. В клиниках лечения алкоголизма в Туле используются оба метода: капельницы для острого состояния и программы реабилитации после лечения запоя. Это помогает в освобождении от зависимости и восстановлении здоровья. Помните, что медицинская помощь в этом аспекте имеет критическое значение для успешного лечения.

Подбирая компании для квартирного перевозки важно учитывать её наличие страховки и репутацию на рынке.

Проверьте отзывы клиентов или рейтинги в интернете, чтобы оценить профессионализм исполнителя.

Сравните цены , учитывая объём вещей, сезонность и дополнительные опции .

https://ferdinand.com.ua/forum/topics/move-team-uslugi-gruzchikov-v-kieve-i-po-vsej-ukraine.19807/

Убедитесь наличия гарантий сохранности имущества и запросите детали компенсации в случае повреждений.

Оцените уровень сервиса: дружелюбие сотрудников , детализацию договора.

Проверьте, есть ли специализированные грузчики и защитные технологии для безопасной транспортировки.

Специалист по зависимостям Тула: Квалифицированная поддержка при зависимостях Если вы или ваши близкие столкнулись с психоактивными веществами‚ необходимо обратиться к профессионалу. Нарколог Тула предлагает профессиональную медицинскую помощь‚ включая оценку состояния зависимого и индивидуальные консультации нарколога. В наркологической клинике доступны различные услуги‚ такие как медикаментозное лечение и психотерапия. Работа с зависимостями – это сложный и многогранный процесс‚ который предполагает индивидуального подхода. Программа реабилитации включает в себя фазы‚ направленные на исцеление физического и психологического состояния больного. Реабилитация наркозависимых также включает поддержку семьи‚ что играет ключевой ролью в успешном лечении. Конфиденциальная помощь даёт возможность пациентам чувствовать себя защищенными и свободными от предвзятости. Профилактика наркомании и помощь при алкоголизме – ключевые направления работы наркологов. Обратитесь на narkolog-tula005.ru для получения подробностей и записи на приём. Помните‚ что раннее обращение – залог успешного исцеления!

подключить интернет по адресу

domashij-internet-krasnoyarsk004.ru

провайдеры интернета по адресу

Проблема алкогольной зависимости является серьезной и требует профессионального вмешательства. В Туле предлагаются услуги вывода из запоя, которые гарантируют безопасное очищение организма и восстановление. Наркологические клиники предоставляют круглосуточную помощь и анонимное лечение, обеспечивая полную конфиденциальность. вывод из запоя тула

Цена капельницы от запоя в Туле: где найти лучшие предложения Алкогольная зависимость — это серьезная проблема, с которой сталкиваются многие люди. Лечение алкоголизма и выход из запоя обычно требуют профессиональной медицинской помощи. Вызов нарколога и услуги нарколога в Туле становятся актуальными для тех, кто хочет избавиться от алкогольной зависимости. Капельница от запоя — это действенный метод восстановления организма после продолжительного приема алкоголя. Стоимость капельниц может отличаться в зависимости от клиники и используемых препаратов. Например, домашняя капельница может быть удобным вариантом, так как вызов врача на дом позволяет получить помощь в комфортной обстановке. Ценник на капельницу определяется составом препаратов и особенностями самой процедуры. В Туле можно найти различные предложения, но важно выбирать клиники с хорошей репутацией. Наркологические услуги включают не только капельницы, но и терапию при алкоголизме, что также стоит учитывать при выборе. Комплексный подход необходим для восстановления после запоя, и лечение таких состояний должно осуществляться квалифицированными специалистами. Помните, что качественные медицинские услуги — это ваша инвестиция в собственное здоровье.

интернет провайдеры в красноярске по адресу дома

domashij-internet-krasnoyarsk005.ru

провайдеры интернета в красноярске по адресу

Наркологическая помощь в Туле: когда нужна экстренная помощь Кризисные ситуации, возникающие из-за зависимости от алкоголя или наркотиков, могут коснуться любого. В такие моменты крайне важно знать, как оперативно получить помощь. Вызов нарколога на дом в Туле может стать настоящим спасением для людей, столкнувшихся с алкогольным отравлением или другими острыми состояниями, связанными с зависимостями. Экстренная помощь от наркологической службы включает возможность вызвать нарколога на дом. Это особенно важно для тех, кто не может или не желает посещать медицинские учреждения. Лечение алкоголизма часто требует вмешательства специалистов, чтобы предотвратить тяжелые последствия. Родственники играют ключевую роль в реабилитации наркоманов и алкоголиков; Психотерапия при зависимостях помогает разобраться в причинах и справиться с трудностями. Информацию о наркологических центрах в Туле можно найти в интернете, однако иногда требуется незамедлительная помощь; нарколог на дом срочно тула Важно помнить, что профилактика зависимости также имеет большое значение. Раннее обращение к специалистам может помочь предотвратить развитие серьезных проблем. Помните, что экстренные меры способны спасти жизнь.

высокое кашпо для цветов напольное из пластика http://kashpo-napolnoe-msk.ru – высокое кашпо для цветов напольное из пластика .

Круглосуточные услуги нарколога в Туле – это важный аспект лечения наркомании. В наркологических центрах, таких как narkolog-tula007.ru, предоставляется анонимное лечение и консультация нарколога. Опытные специалисты предлагает программу по очищению организма, чтобы помочь пациентам преодолеть физическую зависимость. Реабилитация и стационарное лечение зависимых включает психотерапевтическую помощь и поддержку для семей пациентов. Организация медицинской помощи в Туле направлена на профилактику наркотиков и быструю реакцию в кризисных ситуациях. Наркологические услуги работают 24 часа в сутки, что позволяет незамедлительно реагировать на любые обращения и предоставлять пациентам необходимую помощь.

провайдеры по адресу красноярск

domashij-internet-krasnoyarsk006.ru

проверить провайдеров по адресу красноярск

Купить подписчиков в Telegram https://vc.ru/smm-promotion лёгкий способ начать продвижение. Выберите нужный пакет: боты, офферы, живые. Подходит для личных, новостных и коммерческих каналов.

Виртуальные номера для Telegram basolinovoip.com создавайте аккаунты без SIM-карты. Регистрация за минуту, широкий выбор стран, удобная оплата. Идеально для анонимности, работы и продвижения.

Вызов нарколога на дом в экстренных случаях — это важная услуга для тех, кто сталкивается с зависимостями. На сайте narkolog-tula006.ru вы можете получить консультацию нарколога и вызвать врача для домашнего визита. Квалифицированная помощь нарколога включает в себя лечение зависимостей и поддержку при зависимости. Экстренная медицинская служба предлагает анонимную помощь, что позволяет сохранить конфиденциальность. Быстрое лечение наркомании и реабилитация алкоголиков возможны с помощью психотерапевта на дому. Не откладывайте, обратитесь за срочной помощью!

Odjeca i aksesoari za hotele profesionalni stolnjaci po sistemu kljuc u ruke: uniforme za sobarice, recepcionere, SPA ogrtaci, papuce, peskiri. Isporuke direktno od proizvodaca, stampa logotipa, jedinstveni stil.

пансионаты для инвалидов в москве

pansionat-msk001.ru

пансионат для лежачих москва

провайдеры интернета в краснодаре по адресу

domashij-internet-krasnodar004.ru

интернет провайдеры краснодар по адресу

пансионат для лежачих больных

pansionat-msk002.ru

дом престарелых

Нарколог на дому: профессиональная помощь при зависимости Проблема наркотической зависимости требует внимательного и профессионального подхода. Не забывайте, что лечение наркомании начинается с консультации у специалиста. На сайте narkolog-tula007.ru можно получить полную информацию о вызове врача нарколога на дом. Лечение подразумевает проведение детоксикации организма и предоставление психологической помощи. В некоторых случаях необходима реабилитация зависимых, которая включает специализированные программы. Анонимность лечения гарантирует безопасность и комфорт для пациента. Домашняя терапия предоставляет необходимую помощь и особенно важна для тех, кто испытывает стеснение при обращении в медицинские учреждения. Лечение алкогольной зависимости также доступно на дому, что способствует быстрейшему восстановлению. Обращение к квалифицированному специалисту – это залог успешной борьбы с зависимостями.

провайдер по адресу

domashij-internet-krasnodar005.ru

провайдеры по адресу краснодар

הניגוד הזה. כשהיא לקחה את שני הזין בידיה והתחילה לשפשף אותם זה בזה, שני הבחורים גנחו באחדות. השני של האורגזמה, ואני זורק מלפפון על המיטה כדי שלא יפריע לי מתחת לזרועות. הו, זה היה משהו. this page

את זה. בזמן שדיברנו, היא לא עצרה לרגע, והמשיכה ללקק לי את הזין. וזה מדליק. והתחלתי להרגיש הטעם שלה. הזרע של ארטם מעורבב עם השפתון שלה, מריר, ריר של אחרים… אתה אוהב את זה. הגניחה תרשה לעצמך להתפרע על ידי מסג’ים אירוטיים מפנקים

пансионат для людей с деменцией в москве

pansionat-msk003.ru

частный дом престарелых

Práticas seguras é um conjunto de princípios que promovem equilíbrio no setor de apostas online, protegendo jogadores e evitando abusos.

As plataformas precisam implementar recursos como bloqueios temporários , permitindo que os usuários evitem excessos.

A educação sobre jogo consciente é essencial para apoiar jogadores vulneráveis, como padrões compulsivos.

1win site oficial

A verificação de idade evita que menores participem , enquanto parcerias com ONGs reforçam a ética .

Transparência nas regras do jogo assegura justiça, com auditorias independentes fiscalizando práticas.

провайдер по адресу

domashij-internet-krasnodar006.ru

провайдеры интернета в краснодаре по адресу

пансионаты для инвалидов в москве

pansionat-msk001.ru

пансионат для лежачих больных

прогнозы на футбол от экспертов прогнозы на футбол от экспертов .

mostbet az etibarlıdırmı mostbet az etibarlıdırmı

прогнозы на спорт точные luchshie-prognozy-na-khokkej.ru .

частный дом престарелых

pansionat-tula001.ru

пансионат для лежачих пожилых

доставка суши барнаул суши роллы барнаул

Хирургические услуги онкооперации: диагностика, операции, восстановление. Современная клиника, лицензированные специалисты, помощь туристам и резидентам.

Переход на другой тариф интернет и ТВ в Москве — это важный шаг, который может существенно улучшить уровень связи. Чтобы осуществить изменение тарифа, необходимо следовать определённому порядку. domashij-internet-msk004.ru Для начала стоит оценить ваши текущие потребности и изучить тарифные предложения, доступные у провайдеров в Москве. Сравните тарифы, чтобы найти самые привлекательные варианты. Не забудьте о специальных акциях, которые помогут вам сэкономить. Когда вы определились с выбором, смена тарифа осуществляется через личный кабинет на сайте провайдера или по звонку в службу поддержки. Не забудьте уточнить условия подключения и отключения старого тарифа. Это поможет избежать ненужных расходов; Следуя этим советам по выбору тарифа, вы сможете подобрать лучшее решение для подключения интернета и телевидения, соответствующий вашим требованиям.

пансионат для пожилых

pansionat-msk002.ru

пансионат для пожилых с деменцией

В столице России множество интернет-провайдеров, которые предлагают различные интернет-услуги. При выборе провайдера важно учитывать скорость интернета и качество связи. На сайте domashij-internet-msk005.ru можно найти разнообразные тарифы от разных провайдеров, а также отзывы клиентов, что поможет в выборе провайдеров. Мнения пользователей имеют ключевую значение в понимании стабильности соединения и работы техподдержки. Известные провайдеры предлагают различные интернет-пакеты с акциями и скидками, что делает доступ в интернет доступнее. Важно ознакомиться с мнением пользователей, чтобы выбрать наиболее подходящий провайдер для себя.

пансионат с деменцией для пожилых в москве

pansionat-msk003.ru

частный пансионат для пожилых

Магазин брендовых кроссовок https://kicksvibe.ru Nike, Adidas, New Balance, Puma и другие. 100% оригинал, новые коллекции, быстрая доставка, удобная оплата. Стильно, комфортно, доступно!

частные пансионаты для пожилых в туле

pansionat-tula003.ru

дом престарелых в туле

суши роллы барнаул суши на дом барнаул

лечение запоя

https://vivod-iz-zapoya-chelyabinsk001.ru

вывод из запоя

пансионаты для инвалидов в туле

pansionat-tula001.ru

частный дом престарелых

интернет провайдеры нижний новгород

domashij-internet-nizhnij-novgorod004.ru

провайдер интернета по адресу нижний новгород

экстренный вывод из запоя челябинск

vivod-iz-zapoya-chelyabinsk002.ru

лечение запоя челябинск

пансионат для престарелых людей

pansionat-tula002.ru

пансионат для реабилитации после инсульта

Осознанное участие в азартных развлечениях — это комплекс мер , направленный на защиту участников , включая поддержку уязвимых групп.

Сервисы должны внедрять инструменты контроля, такие как временные блокировки, чтобы избежать чрезмерного участия.

Регулярная подготовка персонала помогает выявлять признаки зависимости , например, неожиданные изменения поведения .

вавада казино

Для игроков доступны горячие линии , где можно получить помощь при проблемах с контролем .

Соблюдение стандартов включает проверку возрастных данных для обеспечения прозрачности.

Ключевая цель — создать условия для ответственного досуга, где удовольствие сочетается с вредом для финансов .

интернет провайдеры нижний новгород по адресу

domashij-internet-nizhnij-novgorod005.ru

провайдеры домашнего интернета нижний новгород

вывод из запоя

vivod-iz-zapoya-chelyabinsk003.ru

экстренный вывод из запоя челябинск

Дом Patek Philippe — это эталон часового искусства , где соединяются точность и эстетика .

С историей, уходящей в XIX век компания славится ручной сборкой каждого изделия, требующей многолетнего опыта.

Инновации, такие как автоматические калибры, укрепили репутацию как новатора в индустрии.

Часы Патек Филипп фото

Коллекции Grand Complications демонстрируют сложные калибры и ручную гравировку , подчеркивая статус .

Современные модели сочетают инновационные материалы, сохраняя механическую точность.

Это не просто часы — символ семейных традиций, передающий инженерную элегантность из поколения в поколение.

пансионат для престарелых

pansionat-tula003.ru

частный дом престарелых

Neil Island is a small, peaceful island in the Andaman and Nicobar Islands, India. It’s known for its beautiful beaches, clear blue water, and relaxed atmosphere: how to reach Neil Island

провайдеры интернета по адресу

domashij-internet-nizhnij-novgorod006.ru

проверить провайдера по адресу

экстренный вывод из запоя череповец

vivod-iz-zapoya-cherepovec004.ru

вывод из запоя

лучшие сайты казино топ лицензионных казино

https://xnude.app/

вывод из запоя круглосуточно

https://vivod-iz-zapoya-chelyabinsk001.ru

вывод из запоя

Проблемы с интернетом в новосибирске могут быть разнообразными‚ включая медленный интернет‚ потерю соединения и перебои в работе интернета; Часто такие проблемы возникают из-за технических неисправностей или неправильных настроек роутера. Провайдеры в новосибирске предлагают разнообразные тарифные планы‚ но уровень сервиса может различаться; Если вы встретились с проблемами‚ в первую очередь будет проверка сети. Проверьте‚ нет ли Wi-Fi помех от других устройств. Также стоит связаться в центр технической поддержки вашего интернет-сервис провайдера. Они помогут вам решить проблемы с интернетом и подскажут‚ как повысить скорость соединения. domashij-internet-novosibirsk004.ru Не забывайте‚ что корректные настройки маршрутизатора могут существенно повысить качество связи. Если проблема не решается‚ возможно‚ потребуется поменять интернет-провайдера.

экстренный вывод из запоя

vivod-iz-zapoya-cherepovec005.ru

вывод из запоя череповец

В последние годы интернет в загородной местности Новосибирской области стал неотъемлемой частью жизни жителей дач и обитателей загородных участков. Многие провайдеры в Новосибирске предлагают разнообразные тарифы на интернет, что позволяет найти подходящий тариф, учитывая индивидуальные потребности. домашний интернет тарифы новосибирск Скоростной интернет стал стандартом, обеспечивая подключение к сети для работы и досуга. Оптоволоконный интернет, предоставляемый различными интернет-провайдерами новосибирска, гарантирует стабильное соединение даже в удаленных районах. Для дачников также доступны услуги связи, включая мобильный интернет для загородных домов, что обеспечивает возможность подключения в любое время. Беспроводной интернет для загородных домов становится все более популярным, так как позволяет подключать множество устройств одновременно. При подборе интернет-тарифа важно учитывать характеристики вашего участка и наличие инфраструктуры. Домашний интернет под ключ предлагает удобное решение для тех, кто хочет быстро и без лишних хлопот подключить интернет.

экстренный вывод из запоя череповец

vivod-iz-zapoya-cherepovec006.ru

экстренный вывод из запоя череповец

Подключение оптоволокна в новосибирске: основные провайдеры Оптоволоконный интернет всё больше распространённым в столице. новосибирские провайдеры предоставляют разнообразные тарифные планы на оптоволокно, предоставляя надежное соединение и высокую скорость. Система FTTH (Fiber to the Home) обеспечивает доступ услуг связи для большинства пользователей.При выборе провайдера важно учитывать отзывы клиентов, сравнивать тарифы провайдеров и качеству услуг. Для бизнеса особенно важны решения, обеспечивающие надежное подключение к оптоволокну. domashij-internet-novosibirsk006.ru Преимущества оптоволокна состоят в высокой скорости передачи информации и минимальных потерях сигнала. Монтаж оптоволокна осуществляется быстро и без лишних хлопот; если вы ищете интернет для своей компании или жилого помещения, новосибирские провайдеры предложат наилучшие варианты под ваши нужды.

вывод из запоя круглосуточно

vivod-iz-zapoya-chelyabinsk003.ru

экстренный вывод из запоя

лечение запоя иркутск

vivod-iz-zapoya-irkutsk001.ru

вывод из запоя

купить телефон айфон недорого https://www.kupit-ajfon-cs.ru .

вывод из запоя круглосуточно череповец

vivod-iz-zapoya-cherepovec004.ru

вывод из запоя

подключить интернет

domashij-internet-omsk004.ru

подключить интернет в омске в квартире

Modern operations cardiac surgery innovative technologies, precision and safety. Minimal risk, short recovery period. Plastic surgery, ophthalmology, dermatology, vascular procedures.

Профессиональное https://prp-expert.ru: PRP, Plasmolifting, протоколы и нюансы проведения процедур. Онлайн курс обучения плазмотерапии.

вывод из запоя цена

vivod-iz-zapoya-irkutsk002.ru

вывод из запоя круглосуточно иркутск

Онлайн-курсы https://obuchenie-plasmoterapii.ru: теория, видеоуроки, разбор техник. Обучение с нуля и для практикующих. Доступ к материалам 24/7, сертификат после прохождения, поддержка преподавателя.

Студия дизайна Интерьеров в СПБ. Лучшие условия для заказа и реализации дизайн-проектов под ключ https://cr-design.ru/

¿Necesitas una piscina de jardín ? Las marcas Intex y Bestway ofrecen soluciones innovadoras para todas las familias .

Los modelos con armazón garantizan durabilidad superior , mientras que los modelos hinchables ofrecen comodidad .

Modelos populares incluyen bombas de arena , asegurando higiene óptima .

Para espacios reducidos , las piscinas modulares de 4 m son fáciles de instalar .

Además, accesorios como cobertores térmicos, barandillas resistentes y juegos inflables mejoran la experiencia .

Por su calidad certificada, estas piscinas ofrecen valor a largo plazo .

https://www.mundopiscinas.net

вывод из запоя иркутск

vivod-iz-zapoya-irkutsk003.ru

вывод из запоя цена

недорогой интернет омск

domashij-internet-omsk005.ru

интернет провайдер омск

вывод из запоя

vivod-iz-zapoya-cherepovec005.ru

экстренный вывод из запоя череповец

подключить интернет

domashij-internet-omsk006.ru

интернет провайдеры омск

вывод из запоя круглосуточно

vivod-iz-zapoya-cherepovec006.ru

лечение запоя череповец

экстренный вывод из запоя калуга

vivod-iz-zapoya-kaluga005.ru

вывод из запоя цена

подключить интернет тарифы пермь

domashij-internet-perm004.ru

домашний интернет тарифы пермь

лечение запоя

vivod-iz-zapoya-irkutsk001.ru

вывод из запоя

вывод из запоя цена

vivod-iz-zapoya-kaluga006.ru

вывод из запоя калуга

интернет провайдеры пермь

domashij-internet-perm005.ru

подключить домашний интернет в перми

вывод из запоя

vivod-iz-zapoya-irkutsk002.ru

лечение запоя

вывод из запоя круглосуточно

vivod-iz-zapoya-krasnodar001.ru

вывод из запоя краснодар

купить айфон 8 в спб https://www.kupit-ajfon-cs3.ru .

the best and interesting https://lusitanohorsefinder.com

подключить интернет в квартиру пермь

domashij-internet-perm006.ru

подключить проводной интернет пермь

interesting and new https://www.panamericano.us